The chip supply crisis triggered by the global AI boom is exposing just how fragile the world’s semiconductor chain really is. As the US–China tech war intensifies, access to secure, non-Chinese sources of critical minerals has become a defining strategic concern. For Indonesia, this shift offers new leverage but also underscores a growing vulnerability: an economic model heavily reliant on China at a time when the world is trying to diversify away from it.

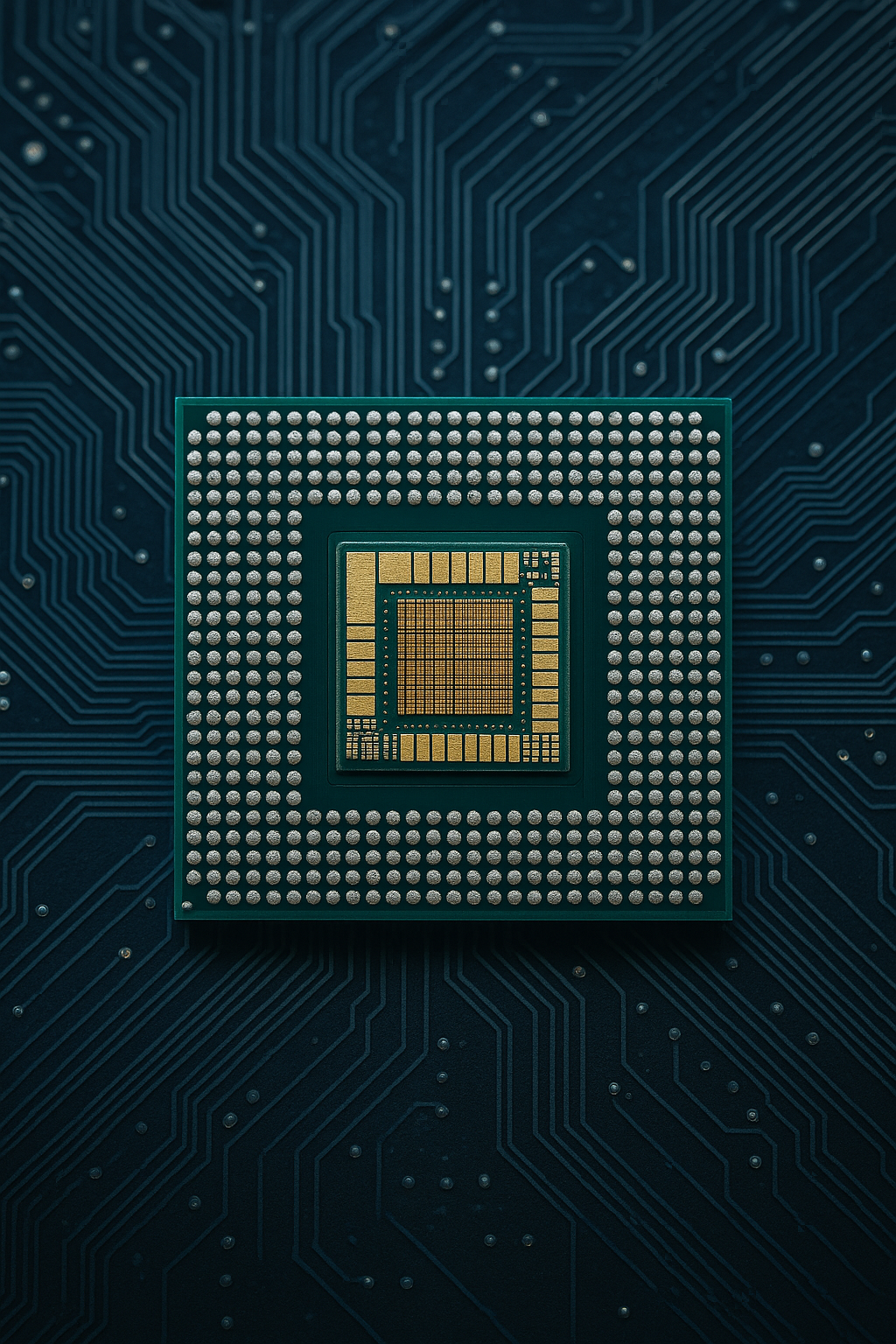

Modern chips begin far from cleanrooms. Before a single wafer is etched, manufacturers rely on minerals like copper, tin, nickel, and cobalt to build the wiring, packaging, and industrial machinery that support chip fabrication. Silicon may be the star, but without these metals, the broader semiconductor ecosystem cannot function. Understanding this upstream reality is essential to grasping why Indonesia, despite having no chip fabs, now sits closer to the heart of the global semiconductor conversation.

How AI Fueled the New Chip Supply Crisis

The surge in artificial intelligence created an unprecedented spike in demand for memory chips, especially those powering data centers and AI training clusters. Analysts say that as companies rushed to secure high-bandwidth memory, they redirected production capacity away from traditional segments, tightening supply across the board. The AI frenzy has contributed to a sharp imbalance that is driving up prices for both advanced and older-generation memory chips.

This shortage is affecting everything from servers to smartphones, and it highlights a simple truth: the world cannot build AI systems without stable, predictable access to the full semiconductor chain.

Why the US–China Tech War Forces a Rethink

The tech war sits on top of older economic tensions. Long before the first export controls on chips, Washington, Brussels, Tokyo, and others had accused China of unfair trading practices: heavy state subsidies that distort semiconductor markets, forced technology transfers through joint ventures, persistent allegations of IP theft, and the dumping of underpriced legacy chips. These disputes helped trigger the Trump-era tariffs that widened the global trade war and ultimately pushed the rivalry deep into the technology sector.

The US–China tech war has made one issue unavoidable: countries are racing to secure non-Chinese supply chains for minerals, refining, and manufacturing. Washington, Tokyo, and Brussels are all pushing for alternative sources to avoid bottlenecks created by China’s dominance in mineral processing and electronics production.

Indonesia’s Mineral Strengths and Its Dependence Risks

Indonesia plays a crucial upstream role through its large reserves of nickel, copper, and tin… all essential to electronics and chip-related industries. Tin, in particular, is vital for solder and electronic packaging, making Indonesia one of the quiet anchors of global circuit-board manufacturing. Nickel and copper support the industrial infrastructure required for chip production and data-center expansion.

Yet much of Indonesia’s downstream processing remains dominated by Chinese firms. In an era defined by supply-chain weaponization, this creates a strategic vulnerability. If China restricts exports, faces sanctions, or shifts industry priorities, Indonesia’s mineral sector could be directly exposed. Reliance on a single major trade partner leaves the country without the resilience that diversified relationships provide.

What This Means for Indonesia’s Future

Indonesia’s mineral wealth gives it influence, but that influence depends on diversification. Building stronger relationships with the U.S., Japan, South Korea, and Europe (especially in refining and downstream processing) would reduce the risk of economic shocks and strengthen Indonesia’s strategic position. With global tensions rising, Indonesia needs a wider set of partners, not deeper dependence on one.

Indonesia does not need to choose sides. But it does need to choose resilience.

1 thought on “Chip Supply Crisis in a US–China Tech War Era: Indonesia’s Role and the Risks of Dependence”